After reviewing your payroll summary, you simply click to submit it.Īlternatively, you can set up automatic payroll, which works best for companies with salaried staff on direct deposit. Depending on the number of workers, it could take five to 15 minutes. However, you must input staff hours to run payroll if you don’t have integrated time-tracking tools. Salaried employees’ pay rates remain in the system, so you don’t have to enter their hours manually.

Then, employers select hourly or salaried employees, wage rates and additional pay types, and they’re ready to go.Įnable QuickBooks Workforce to allow your team to view payroll and tax information online. Employees enter information about their bank accounts and complete W-4 forms online. We appreciated the timely alerts for upcoming tax payments, which allowed us to see the tax type, payment status and method.īecause some QuickBooks Online Payroll versions include Intuit’s new (as of June 2023) employee workforce portal, adding new team members or updating information is simple. Also, you can tap on shortcuts to quickly run payroll, pay a contractor, and add an employee or contractor. The main screen shows your auto payroll status, upcoming birthdays and a to-do list.

In each case, the software was easy for new users to navigate, and if you’re familiar with the QuickBooks Online bookkeeping software, you’ll quickly recognize the layout.

When evaluating Intuit QuickBooks Payroll, we explored the online interface, mobile apps and workforce portal.

Unlike its competitors’ entry-level plans, QuickBooks Payroll’s entry-level plan does not encompass local taxes or support multistate payroll and tax filings. Retirement and health benefits are more limited with QuickBooks than with Rippling and ADP. QuickBooks Online Payroll offers fewer onboarding and hiring tools than Gusto and OnPay do.

What We Don’t Like About QuickBooks Payroll

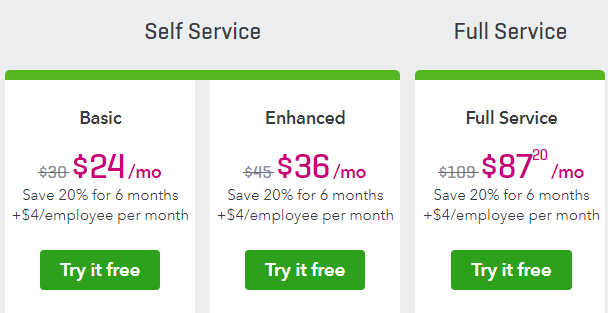

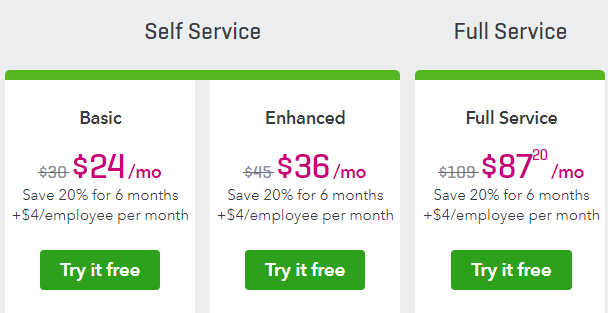

QuickBooks Payroll comes in an affordable contractors-only version with one monthly payment for up to 20 independent contractors or freelancers. The software automatically syncs payroll and tax data, thereby reducing accounting errors and saving time. The competitive price and multiple subscription options make QuickBooks Payroll a flexible solution for small to midsize businesses. QuickBooks offers tax penalty protection of up to $25,000 per year, which can help small businesses avoid unexpected expenses. Miscalculating your payroll liabilities can result in IRS fines. View essential payroll information from your QuickBooks dashboard. The standard processing time among competitors is two to four days. Furthermore, we were impressed that QuickBooks Online Payroll offers eligible users next-day direct deposit on its base package and same-day direct deposit for Premium and Elite plans. The Premium and Elite plans include time-tracking tools and workers’ comp administration through AP Intego. The QuickBooks Payroll Core package handles tax filing and payments, and also offers employee health benefits and 401(k) plans. These features and others make QuickBooks Payroll the best online payroll service for businesses seeking an accounting integration. QuickBooks Payroll’s ease of use for running payroll, calculating employee deductions and viewing reports also factored into our assessment. However, QuickBooks Online is a market leader, with ICSID reporting that 29 million U.S. Only Patriot Payroll offers similar integration with its accounting software. Other payroll providers, like Paychex, charge fees for general ledger integrations. With a single solution like this, we love that you don’t have to integrate payroll with third-party tools or reenter payroll data into your accounting program. QuickBooks Online users can add payroll services to their existing subscriptions, while new customers can bundle payroll and bookkeeping or select a stand-alone Intuit QuickBooks Payroll plan. Why We Chose QuickBooks Payroll for Accounting IntegrationĪs small businesses look to consolidate vendor contracts and streamline operations, Intuit QuickBooks offers the ideal solution for payroll and accounting needs.

Intuit QuickBooks Payroll Editor’s Score: 9/10

0 kommentar(er)

0 kommentar(er)